7 King Street, Richmond, North Yorkshire, DL10 4HP

Muker, Richmond

Richmond

Offers over £ 325,000

Shop with Living Accommodation.

3 1

Contact us

About the property

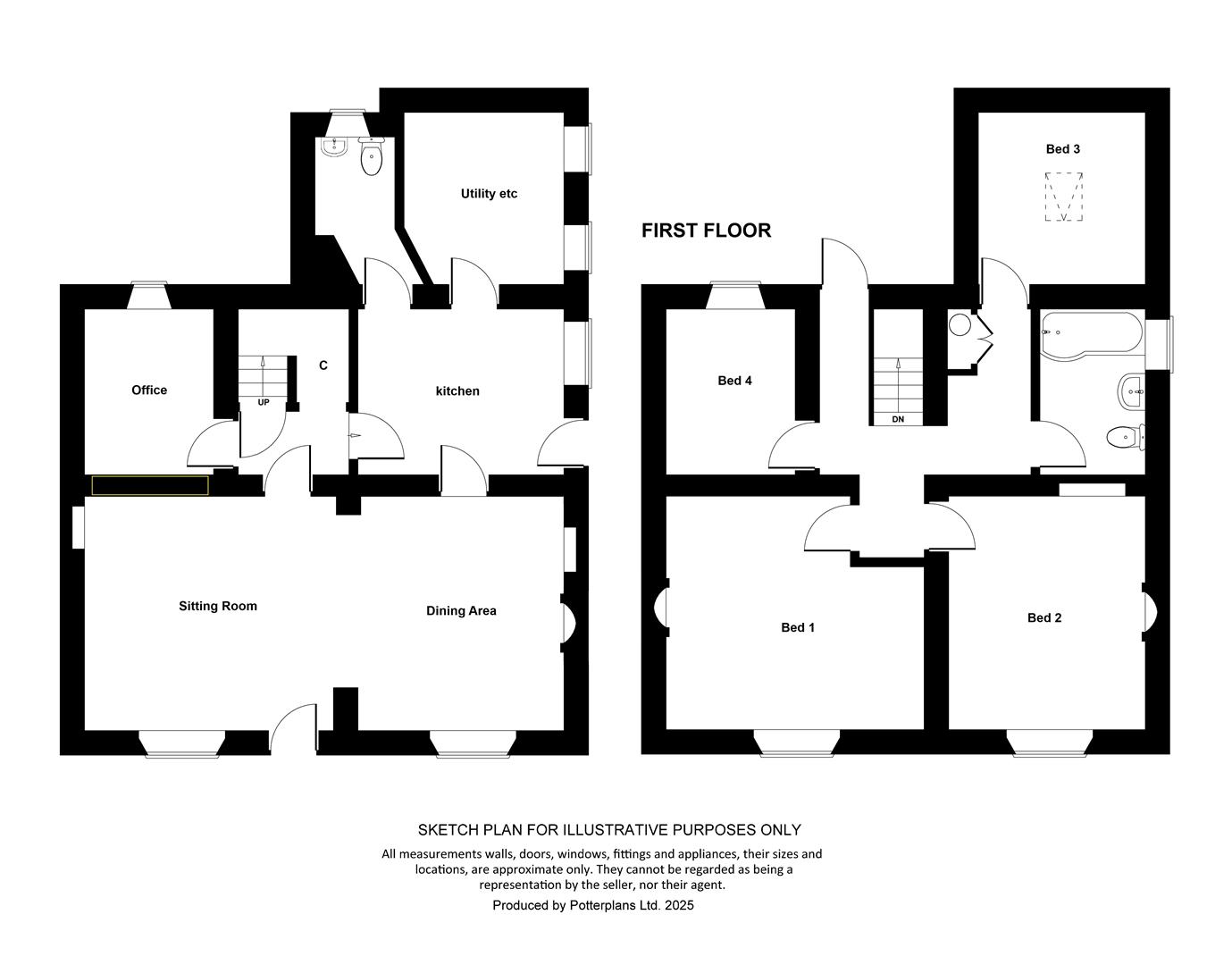

Very Desirable LIFE-CHANGING Opportunity: Prominent SHOP with LIVING ACCOMMODATION in the heart of the beautiful Yorkshire Dales. For Sale with NO ONWARD CHAIN, & Business for Sale also - Please Ask. 7.98m (26'2") Double-fronted Main SHOP etc., AREA, OFFICE, 2 STOREROOMS & WASHROOM/WC; Upstairs are currently 2-3 BEDROOMS, a KITCHEN & a BATH/SHOWER ROOM. UPVC Double-Glazing & Oil Central Heating (New boiler 20XX). Stone-flagged front & small rear Patio Area. ESSENTIAL VIEWING…!!

MUKER has changed little over time & is one of the area's most popular destinations. The scenery is SPECTACULAR & there are amazing places to explore: the drive over the famous Buttertubs Pass & renown walks to suit all: Alf White’s (James Herriot’s) favourite walk on nearby Kisdon Hill & Black Hill, The Coast to Coast, the Pennine Way & the Herriot Way - plus great cycling. Muker is famous for its internationally important species-rich hay meadows, now designated a Site of Special Scientific Interest (SSSI) NB: Muker is pronounced 'MEW-ker'.

MUKER has changed little over time & is one of the area's most popular destinations. The scenery is SPECTACULAR & there are amazing places to explore: the drive over the famous Buttertubs Pass & renown walks to suit all: Alf White’s (James Herriot’s) favourite walk on nearby Kisdon Hill & Black Hill, The Coast to Coast, the Pennine Way & the Herriot Way - plus great cycling. Muker is famous for its internationally important species-rich hay meadows, now designated a Site of Special Scientific Interest (SSSI) NB: Muker is pronounced 'MEW-ker'.

Gallery

Full property details

Main SHOP AREA

7.98m x 3.82m (26'2" x 12'6")

A great creative space ideal for several uses. with potential to extend (See floor plan). Feature cast fireplace, ceiling beams, shelved nooks & exposed stonework. 2 UPVC double-glazed sash windows to front, closed doorway to REAR HALL & door to:

OFFICE

3.21m x 2.60m (10'6" x 8'6")

Ceiling beam, UPVC double-glazed sash window & door to side, doors to INNER HALL &:

WASHROOM/WC

1.57m min x 1.31m (5'1" min x 4'3")

Washbasin , WC & window to rear.

STOREROOM 1.

2.64m x 2.56m (8'7" x 8'4")

Ceiling beams & exposed ceiling timbers. 2 UPVC double-glazed windows to side.

INNER HALL

Staircase to first floor with sizeable storage area under & doorway to:

STOREROOM 2.

2.66m x 2.09m (8'8" x 6'10")

UPVC double-glazed window to rear.

FIRST FLOOR Half LANDING

UPVC double-glazed door to outside.

FIRST FLOOR LANDING

KITCHEN (VIEWS)

2.66m x 2.14m (8'8" x 7'0")

Fitted wall & floor units with worktops & inset sink. Integrated oven/grill & ceramic hob with extractor over. UPVC double-glazed window to rear with fine views.

SITTING ROOM/BEDROOM 1.

4.20m max x 3.82m (13'9" max x 12'6")

Feature cast fireplace & UPVC double-glazed sash window to front.

BEDROOM 2.

3.82m x 3.21m (12'6" x 10'6")

Feature cast fireplace, shelved nook & UPVC double-glazed sash window to front.

INNER LANDING

Built-in double cupboard with hot-water cylinder.

BEDROOM 3.

2.76m x 2.55m (9'0" x 8'4")

Beamed ceiling & Velux window.

BATH/SHOWER ROOM

2.50m x 1.63m (8'2" x 5'4")

Contemporary suite with 'P-shaped' bath with shower-bar over, washbasin & WC. UPVC double glazed window to side.

OUTSIDE FRONT

Stone-flagged patio area with low stone boundary wall & flower/shrub borders. Side access to:

OUTSIDE REAR

Small gravelled area with great views & oil boiler.

NOTES

(1) Freehold

(2) Council Tax Band: Apartment: A

(3) Business Rates: Current Rateable Value (1st April 2023 to present) £5,600. NB: Small Business Rate Relief is 100% for properties with a rateable value under £11,999. This applies if you occupy only 1 property with a rateable value of under £15,000, or you occupy one main property with a rateable value of under £15,000 & other additional properties. Each additional property must have a rateable value of £2,899 or less & the total rateable value of all your properties is £19,999 or less. Small business rate relief is only available for occupied properties. You must be the ratepayer or a person authorised to act on behalf of the ratepayer to submit an application for small business rate relief.

(4) CEPC: 90-D

(5) Shared side access.

(2) Council Tax Band: Apartment: A

(3) Business Rates: Current Rateable Value (1st April 2023 to present) £5,600. NB: Small Business Rate Relief is 100% for properties with a rateable value under £11,999. This applies if you occupy only 1 property with a rateable value of under £15,000, or you occupy one main property with a rateable value of under £15,000 & other additional properties. Each additional property must have a rateable value of £2,899 or less & the total rateable value of all your properties is £19,999 or less. Small business rate relief is only available for occupied properties. You must be the ratepayer or a person authorised to act on behalf of the ratepayer to submit an application for small business rate relief.

(4) CEPC: 90-D

(5) Shared side access.

Floor plan

Map

Take a look

Featured properties

Character Property - Semi Detached. |

Richmond Road, Brompton On Swale, Richmond |

Brompton On Swale 2 2 |

Offers over £ 440,000 |

For Sale |

House - Detached. |

Mallard Road, Scotton, Catterick Garrison |

Catterick Garrison 3 |

Offers over £ 190,000 |

For Sale |

House - Semi-Detached. |

Beechwood Grove, Colburn, Catterick Garrison |

Catterick Garrison 3 2 1 |

Asking price £ 195,000 |

For Sale |

House - Detached. |

The Avenue, Richmond |

Richmond 4 2 2 |

£ 559,950 |

For Sale |

About Marcus Alderson

If you’re looking to sell your home, we offer a fast, free and efficient market appraisal service. With well over 80 years experience in estate agency and extensive local knowledge, we pride ourselves on making honest and accurate market valuations, and we have the track record to prove it!

Contact

-

Marcus Alderson Estate Agents,

7 King Street,

Richmond,

North Yorkshire,

DL10 4HP

Sign up for our latest news

Navigation

Copyright 2025 © Marcus Anderson Estate Agents | Design and Build by In Studio